Nvidia, the world’s leading AI chipmaker, just delivered one of the most talked-about earnings reports of the year. The company’s Q1 fiscal 2026 results blew past expectations, sending shockwaves through the stock market and setting a bold tone for the future of artificial intelligence and cloud computing. If your business touches AI, tech infrastructure, or digital innovation in any way — this is the report you need to understand.

Nvidia Earnings Call Highlights

Massive Revenue Surge:

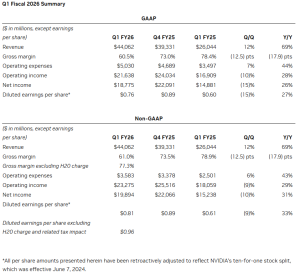

Nvidia reported $44.1 billion in revenue for the quarter, up a staggering 69% year-over-year and 12% from the previous quarter. This marked another record-breaking quarter and was driven largely by booming demand for AI chips and servers. The company’s data center business alone brought in $39.1 billion — a 73% increase compared to the same quarter last year.

Strong Profits Despite Headwinds:

Despite taking a $4.5 billion charge related to unsold H20 GPUs in China due to U.S. export controls, Nvidia still posted a net income of $18.8 billion. Adjusted (non-GAAP) margins remained strong at over 71%, showing that the core business remains incredibly profitable.

CEO’s Confident Tone:

CEO Jensen Huang described the company’s AI infrastructure as “essential as electricity and the internet.” He emphasized the unprecedented scale of AI workloads globally and noted that Nvidia’s new Blackwell NVL72 AI supercomputer is already in full-scale production across major cloud providers.

Looking Ahead:

While the company projected next-quarter revenue of around $45 billion, it warned of an $8 billion impact from new restrictions on sales to China. Still, Nvidia’s forward guidance shows confidence in continued demand from markets outside of China, particularly in the U.S., Europe, and emerging economies.

Nvidia Stock Surges Despite Tariffs

Investors responded with enthusiasm. Nvidia’s stock price spiked by as much as 5.8% in after-hours trading and ended the day up 4.8%. Analysts noted that even with the export ban on Chinese chip sales, the results were far stronger than expected.

Several key points drove the bullish reaction:

-

Strong data center and AI infrastructure demand.

-

Resilience despite geopolitical headwinds.

-

Positive future guidance, showing continued growth beyond China.

Overall, investors interpreted the results as confirmation that Nvidia is not just leading the AI race — it’s accelerating.

Why This Matters to Our Businesses and Partners

Nvidia’s results don’t just matter to Wall Street — they’re a signal to every tech-forward business about where the world is heading.

1. AI Is Not a Trend — It’s A New Frontier For Infrastructure

The jump in AI chip sales confirms that companies are scaling their AI operations at record speed. Whether you’re in marketing, logistics, finance, or health, AI is becoming part of the operational backbone.

For partners in TTR Group’s network, this validates the importance of investing in scalable AI tools, platforms, and infrastructure today — not tomorrow.

2. The Data Center Economy Is Booming

With a 73% year-over-year increase in data center sales, it’s clear the next phase of cloud growth is all about AI. This is great news for businesses offering:

-

Cloud services

-

Infrastructure support

-

Cybersecurity

-

Enterprise AI software

The ripple effect of Nvidia’s growth reaches far beyond silicon. It touches service providers, integrators, and cloud-based platforms across the ecosystem.

3. Supply Chain Risks Are Real

The $4.5 billion inventory write-off caused by U.S.–China trade restrictions is a warning sign. Businesses relying on cross-border tech flow should prepare for more disruption.

For companies in high-growth regions or sectors, this is a moment to rethink supply chains, diversify sourcing, or localize operations to avoid getting caught in regulatory fallout.

4. Hardware-Software Synergy Will Be Critical

Nvidia’s rise isn’t just about powerful chips — it’s also about its software stack, which allows developers to quickly deploy AI at scale. Businesses building AI applications should consider how tightly coupled their software is with the available infrastructure.

By aligning with technologies that Nvidia is investing in, such as CUDA and Blackwell systems, partners can future-proof their platforms.

So What To Expect Next: The AI Race Is Speeding Up

Nvidia’s earnings confirmed what many suspected — we’re not just in the early innings of the AI boom. We’re already seeing the transformation take hold across every industry.

For businesses and innovators, the takeaway is simple:

-

AI is here.

-

The infrastructure is scaling fast.

-

Those who adapt early will lead.

Stay tuned for Nvidia’s next quarter — and in the meantime, consider how your company can ride this wave of AI-driven growth. Whether it’s partnerships, technology upgrades, or new product development, now is the time to act.